santa clara county property tax credit card fee

Non-refundable processing fee of 25. The County of Santa Clara Department of Tax and Collections DTAC representatives remind property owners that the second installment of the 2021-2022 property taxes is due February 1 and becomes delinquent at 5 pm.

Solved Revenue Gross Sales Less Sales Returns And Allow Chegg Com Cost Of Goods Sold Cost Of Goods Payroll Taxes

If Santa Clara County property tax rates have been too costly for you resulting in delinquent property tax payments.

. You will be levied a fee for credit card or debit card. The average property tax rate in Santa Clara County is 067 of the market value of the home which is below the state average of 074 statewide. The county does provide a web portal to pay your tax bills.

Non-Indigent Payment Plan Terms and Conditions. 730 AM - 430 PM. Pay a partial amount on your tax bill only available for secured propertyhomes buildings and land.

See what your property tax dollars support. They often bill consumers a fraction of any tax savings rather than flat out-of-pocket fee. Residents of the county can expect to pay an average of 4694 in property taxes each year.

First installment penalty 10 of the first installment amount plus 2000 cost. For Secured property only DEPARTMENT OF TAX AND COLLECTIONS PO BOX 60534 CITY OF INDUSTRY CA 91716-0534. Payment Plan available to the Registered Owner only.

5 unit over 4 units up to 40 units jurisdiction. Pay your bill with a device using eCheck or CreditDebit card. The fee amount is based upon a percentage of the transaction.

See property tax rates and equalized assessed values. 2021-2022 for July 01 2021 through June 30 2022. Visit their website and pay your real estate tax bill online.

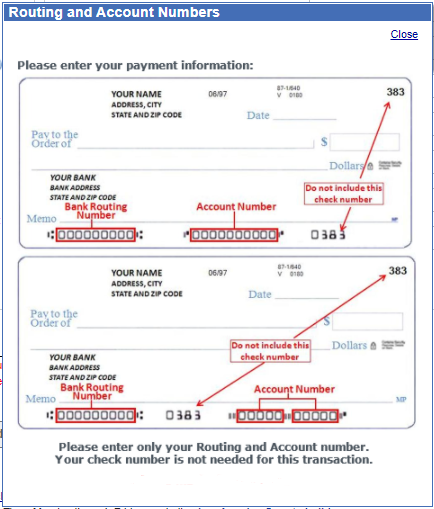

Credit card convenience fee amounts are detailed on the website. Payment Type Former Rate Former Service Fee on 6000 Payment New Rate New Service Fee on. SECURED PROPERTY TAX BILL TAX YEAR.

Property Tax Distribution Charts. Look for a company that works best for you in our list of the best property tax protest companies in Santa Clara County CA. Visit their website and pay your real estate tax bill online.

See how 1 assessed-value property taxes are distributed. We do not accept credit card payments over the phone. View the tax payment history for your property.

You can also pay your property tax bill in person but lines for in-person payments can be long particularly as the tax deadline approaches. ASSESSED VALUES LAND IMPROVEMENTS. Registered Owner must present a valid government-issued ID.

Second installment penalty 10 of the second installment amount plus 20 cost. San Jose CA 95112. The first installment is due on Nov.

Your Santa Clara property taxes are due in two installments per year. The current convenience fees are. The fee for debit cards will increase from 395 per payment to 225 of the payment amount.

Review all active property tax bills for your property. If you elect to pay by credit card please be aware that these fees are added to your transaction. A secure online payment system will make it convenient for property owners to pay their taxes said Cheryl Johnson Santa Clara County Tax.

COUNTY OF SANTA CLARA SECURED PROPERTY TAXES - 2ND INSTALLMENT. Credit card convenience fee amounts are detailed on the website. Credit and Debit Card convenience fee amounts are detailed on the payment site.

There is however a fee for paying by credit card. We accept payments of cash checks and credit cards Subject to transaction fee see below. 1555 Berger Drive Suite 300.

If paying by credit or debit card a convenience fee is charged by the payment processing company. 0802 CITY OF SAN JOSE LIBRARY PARCEL TAX 800-441-8280 3688 0847 SANTA CLARA COUNTY-VECTOR CTRL SCCO VECTOR CONTROL 800-273-5167 x105 508. Property Tax Rate Book.

Enter Property Parcel Number APN. TRANSACTION FEES Minimum Transaction Fee. Please be advised any notices sent by the Department of Tax and Collections will have the County Seal and the Department of Tax and Collections contact information.

If you have any questions please call 408-808-7900. At the time of enrollment. Department of Environmental Health.

Paper property tax bills are sent too but they can take a while to make it to your mailbox. Accepting MasterCard Discover Visa. There is no fee if you pay by electronic check.

A convenience fee of 225 percent of the transaction amount is associated with a credit or debit card transaction charged by the payment vendor. As an example the former service fee and the new service fee for payments made with a credit or debit card for a 6000 Annual Secured Property Tax bill would be. Here is the Santa Clara County Property Tax Mailing Address.

On Monday April 11 2022. To avoid financial penalties the second installment of the 20022003 property taxes must be paid by 500 pm Thursday April 10 2003. Read an overview of the administration of property taxes and the collection and distribution of taxes.

Please make checks payable to County of Santa Clara. 0847 santa clara county-vector ctrl scco vector control 800-273-5167 x105 508 0848 santa clara county-vector ctrl mosquito asmt 2 800-273-5167 x105 874 0851 santa clara county-library jpa library jpa cd 2013-1 408-293-2326 x3004 3366 0883 santa clara valley water dist flood ctl debt-east 408-630-2810 2090. 395 for charges up to 175.

If your payment is not received or postmarked by the delinquent dates the penalty amounts are the same as secured taxes. CreditDebit Card 225 of the taxes being paid minimum 250 convenience charge eCheck No convenience fee for the taxpayer. Taxpayers may also mail their tax installment payment along with the second installment stub to the Department of Tax and Collections PO Box 60534 City of Industry CA 91716-0534.

Notices such as these are not authorized nor sent by the County of Santa Clara Department of Tax and Collections. COUNTY OF SANTA CLARA SECURED PROPERTY TAXES - 2ND INSTALLMENT SEC-REG-202108. Search for property tax bills by address or APN.

50 Private Car Sale Contract Payments Free To Edit Download Print Cocodoc

Back To The Future 2 Vista Credit Card Label

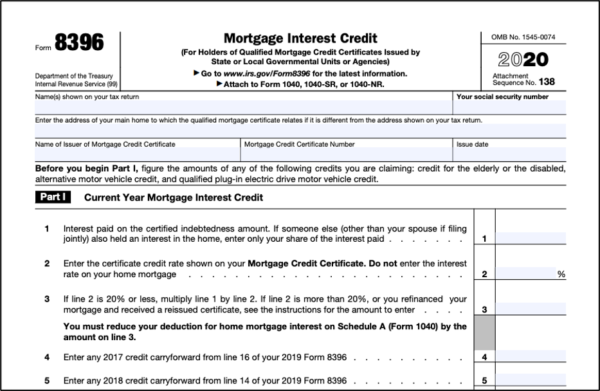

What Is A Mortgage Credit Certificate Mcc And Are They Worth It

Secured Property Taxes Tax Collector

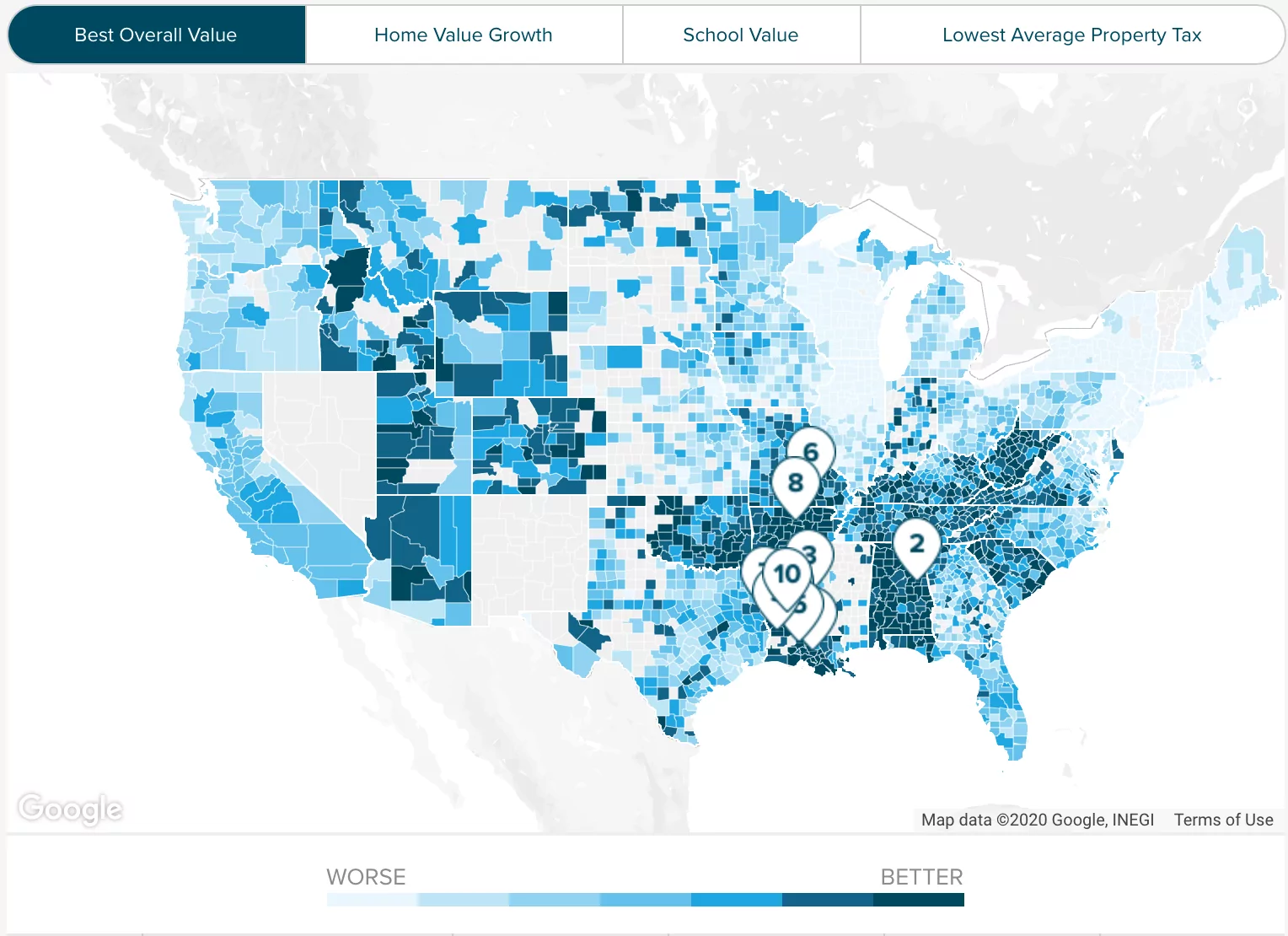

Santa Clara County Ca Property Tax Calculator Smartasset

Back To The Future 2 Vista Credit Card Label

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

50 Private Car Sale Contract Payments Free To Edit Download Print Cocodoc

Santa Clara County Ca Property Tax Calculator Smartasset

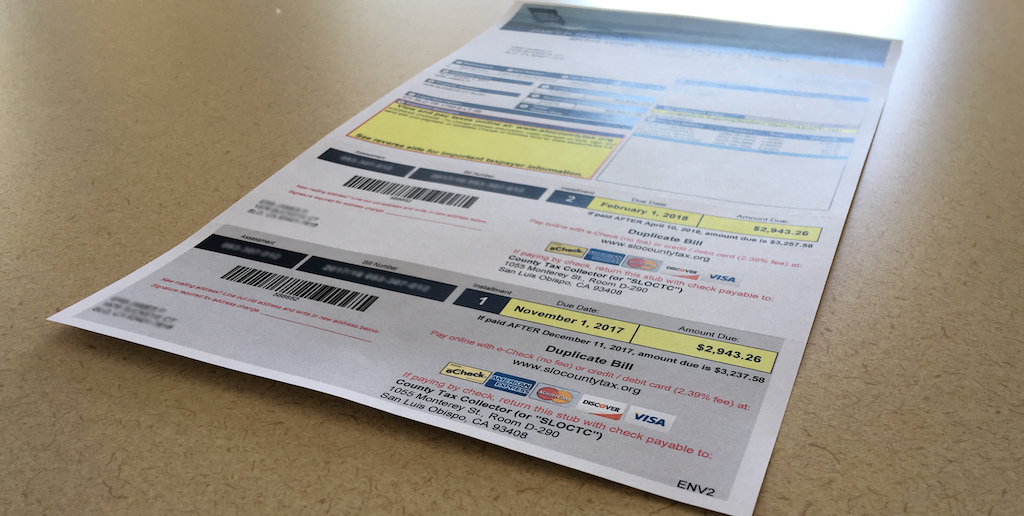

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

Bay Area Home Prices Reach Record Highs But Sales Tumble House Prices Tumbling Price

Flintstones In Viva Rock Vegas Prop Bronto Crane Test Credit Card

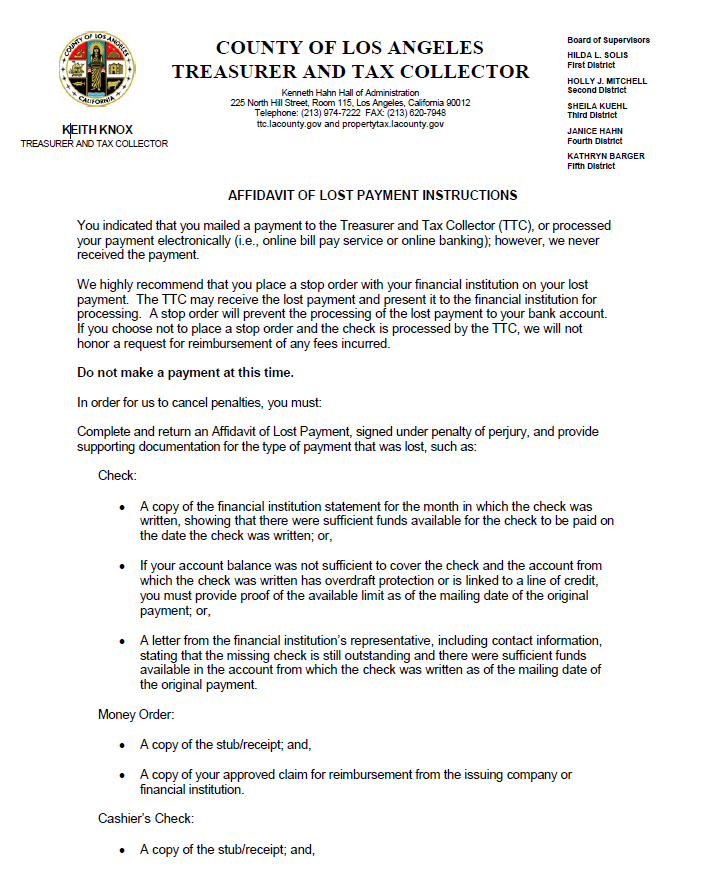

Penalty Cancellation Due To A Lost Payment Affidavit Treasurer And Tax Collector

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Quickbooks Online How To Record And Process Credit Card Payments

What Is A Mortgage Credit Certificate Mcc And Are They Worth It

What Is A Homestead Exemption California Property Taxes

Where Can You Download A Csv Or Ms Excel Format Of All Your Wells Fargo Credit Card Transactions Quora