alameda county property tax 2021

Being mailed this month by Alameda County Treasurer and Tax Collector Henry C. There should be no cost to you and you also can make a little interest as the money sits.

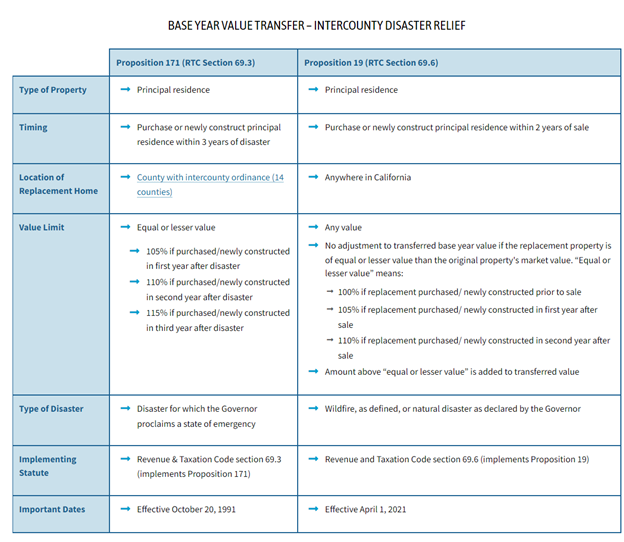

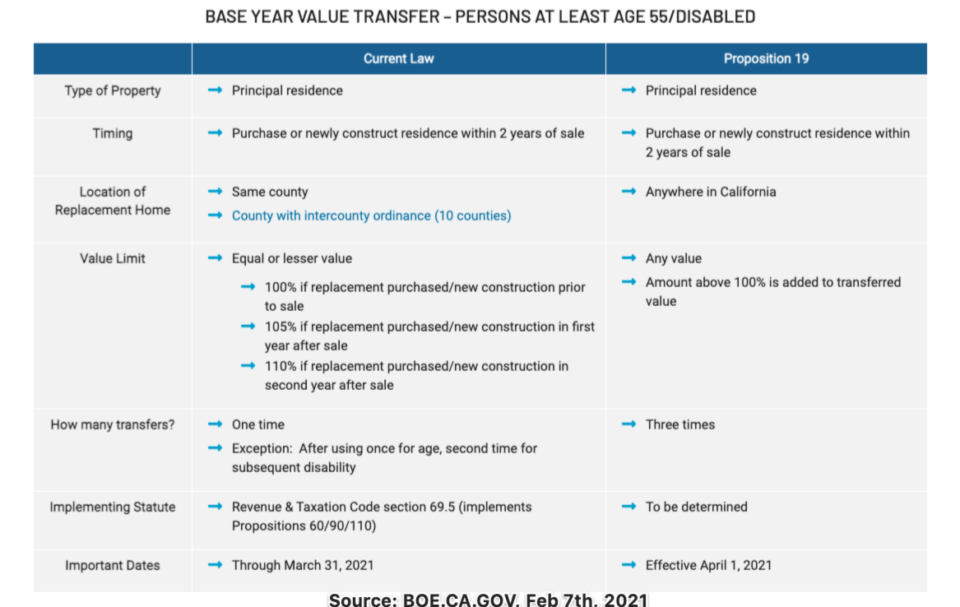

Proposition 19 Contra Costa County Ca Official Website

For tax balances please choose one of the following tax types.

. Most supplemental tax bills are payable online to 6302022. This site also enables you to access your tax information. 125 12th Street Suite 320 Oakland CA 94607.

For purposes of preparing special assessments class numbers beginning with Z should be used. Alameda County collects on average 068 of a propertys assessed fair market value as property tax. Prior to doing so consider what the valuation actually does to your annual tax payment.

If your application is successful youll be allowed to defer payment of your property taxes in accordance with the Soldiers and Sailors Civil Relief Act. Secured tax bills are payable online from 1062021 to 6302022. Multiple years available for comparison.

Provides the rates levied by various districts as a result of voter-approved debtbonds. Your deferred payments wont rack up late fees but they will be subject to a 6. Use this account to pay for your property tax payments when due.

Separate filings are required for each business location. To request immediate release please contact us at 510272-6800 Monday - Friday 830am - 430pm with your transaction number. The median property tax in Alameda County California is 3993 per year for a home worth the median value of 590900.

Please Enter Your Assessee Account Number. The tax type should appear in the upper left corner of your bill. Ad See Anyones Official Alameda County Records.

The TTC accepts payments online by mail or over the telephone. Most districts have multiple class numbers. Any attempts to collect in-person payments are fraudulent.

The secured roll taxes due are payable by November 1 2021 and will be delinquent by December 10. Claim for transfer of base year value to replacement. The Alameda County Treasurer-Tax Collector Announces Policies and Procedures for COVID-19 Related Delinquent Property Tax Penalty Interest Waiver.

Pay Your Property Taxes Online. CLASS TAX RATE AREA. Provides tax rate information for all tax rate areas within the County.

Enter A Name To See Results Instantly. 125 12th Street Suite 320. Claim for disabled veterans property tax exemption.

Military personnel can apply for Alameda Countys Property Tax Relief for Military Personnel. Ad Find Alameda County Online Property Records Info From 2021. You can search for tax rates based on parcel number address city or unincorporated representative area or tax rate area.

Find Information On Any Alameda County Property. We accept Visa MasterCard Discover and American Express. No fee for an electronic check from your checking or savings account.

The primary purpose of a tax sale is to collect taxes that have not been paid by the property owner for at least five years. Claim for reassessment exclusion fortransfer between parent and child. Look Up Your Property Taxes.

Dear Alameda County Residents. ALAMEDA COUNTY SECURED ROLL PROPERTY TAXES. Filing Form 571L Business Property Statement.

A convenience fee of 25 will be charged for a credit card transaction. DUE FOR THE FISCAL YEAR 2021-2022. Find your real property tax bill incorporating any exemptions that pertain.

No person shall use or permit the use of the Parcel Viewer for any purpose other than the conduct of official Alameda County business. Parcel Number How do I find my parcel number. Alameda County Apportionment and Allocation of Property Tax Revenues -1- Audit Report The State Controllers Office SCO audited Alameda Countys process for apportioning and allocating property tax revenues to determine whether the county complied with California statutes for the period of July 1 2016 through June 30 2019.

Levy to all real property owners of record in the Alameda County Assessors Office. -Select- Alameda Albany Berkeley Castro Valley Countywide-Unitary Dublin Emeryville Fremont Hayward Livermore Mountain House School Newark Oakland Piedmont Pleasanton San. Alameda County Assessors Office 1221 Oak Street Room 145 Oakland CA 94612.

Welcome to the Alameda County Treasurer-Tax Collectors website. Prior Year Delinquent tax payments are payable online to 6302022. Businesses are required by law to file an annual Business Property Statement BPS if their aggregate cost of business personal property is 100000 or greater or if the Assessor requests the information in writing.

Alameda County Treasurer-Tax Collector. Decline in Market Value 2021-2022 Informal Request Form PDF. In the absence of a Z class use the B class.

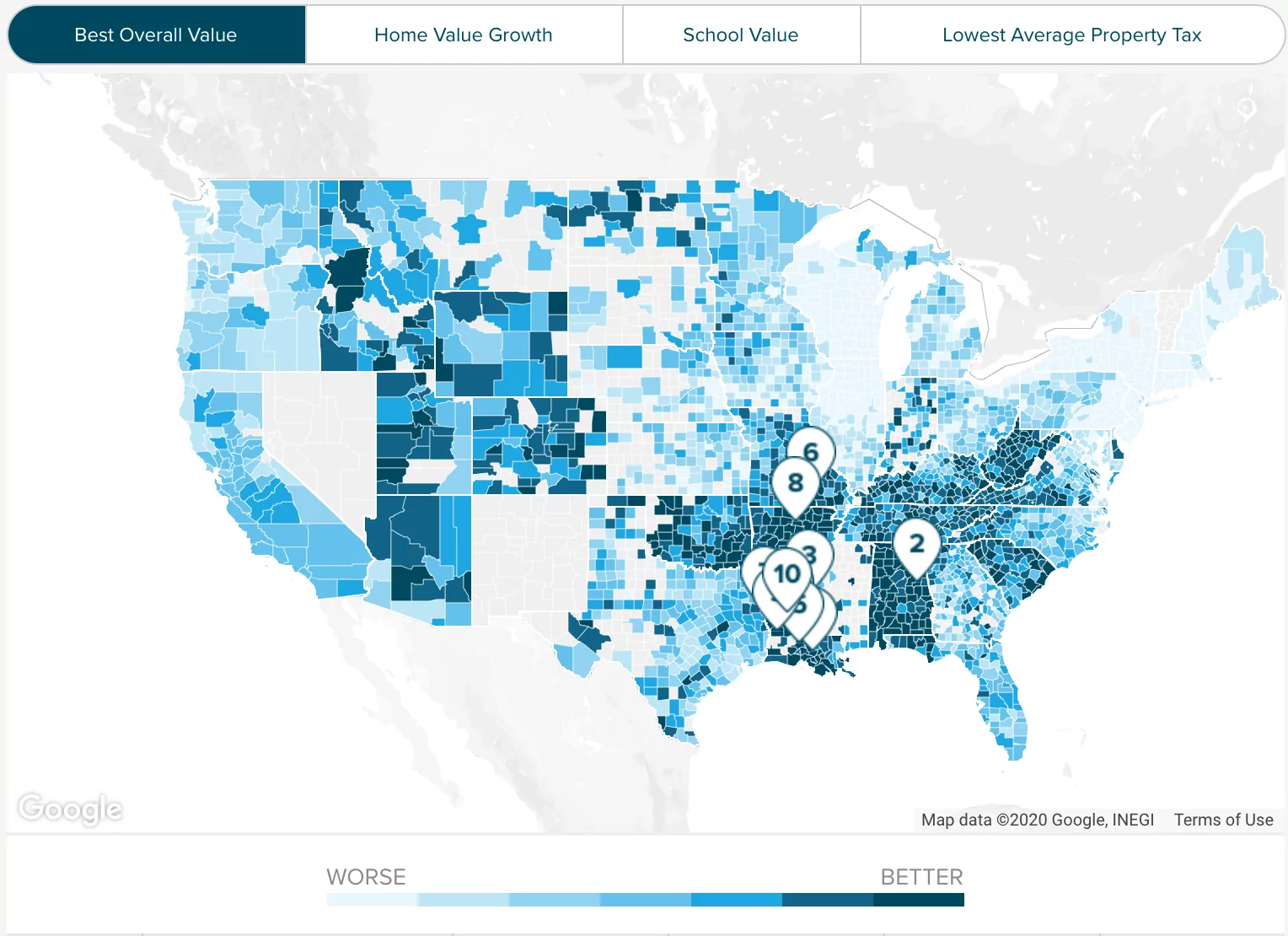

You can use the interactive map below to look up property tax data in Alameda County and beyond. Offering the property at public auction achieves this by either selling the property or by forcing payment of the property taxes. For payments made online a convenience fee of 25 will be charged for a credit card transaction.

No fee for an electronic check from your checking or savings account. The Parcel Viewer is the property of Alameda County and shall be used only for conducting the official business of Alameda County. If your property has been affected by the recent Canyon Fire in the Sunol Pleasanton or Niles-Fremont region please click here for the Application for Reassessment of Damaged or Destroyed Property and more information on Disaster Relief.

Property Tax Cash Payments Accepted by East West Bank. If you have any questions about the application or disaster relief please call our office at 510 272. The Alameda County Treasurer-Tax Collector Continues to Encourage Online Payment for 2020-2021 Property Taxes.

TTC does not conduct in-person visits to collect property taxes. For alameda county boe-19-b. You can pay online by credit card or by electronic check from your checking or savings account.

Show Prior Year Tax History for Parcel Number. Property Tax Data. Any real estate owner can question a real property tax assessment.

Our staff have worked hard to provide you with online services that provide useful information about our office our work and our fiduciary obligation to safe-keep the Countys financial resources. Alameda County Administration Building 1221 Oak Street Room 131 Oakland California 94612. 12172021 15001 PM.

Information reflective of 2021 Recorder Assessor Data. Browse Geographies within Greenbank CA - Street. - - - - - -.

E-check payments are the same as regular checks and will take thirty 30 days to release a lien andor a boat hold. 1221 Oak Street Room 131 Oakland CA 94612. Search by Assessee Account Number.

The Class number used in these reports contain an alpha character used internally and the districts 4-digit fund number. Use in the conduct of official Alameda County business means using or. During those five years the taxpayer has repeatedly been notified of a.

Search Secured Supplemental and Prior Year Delinquent Property Taxes. Enter just one of the following choices and click the corresponding Search button. If you have to go to court you may need service of one of the best property tax attorneys in Alameda County CA.

Image of the City of Berkeley. Alameda County Assessors Office 1221 Oak Street Room 145 Oakland CA 94612. Alameda County has one of the highest median property taxes in the United States and is ranked 68th of the 3143 counties in order of median property taxes.

You can place your check payment in the drop box located at the. Alameda County Assessors Office 1221 Oak Street Room 145 Oakland CA 94612.

Decline In Market Value Alameda County Assessor

2021 Ballot Guide Centennial Institute

Prop 19 And Property Taxes In California Marc Lyman

Alameda County Property Tax News Announcements 11 08 21

Business Property Tax In California What You Need To Know

Free Open House Flyers For Realtors 2021 Remarkable Ideas

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

Birmingham Mi Real Estate Birmingham Homes For Sale Realtor Com Living Room Dimensions Dining Room Dimensions Bedroom Dimensions

Most Expensive U S Zip Codes In 2021 Propertyshark

Proposition 19 Alameda County Assessor

Search Unsecured Property Taxes

Proposition 19 Alameda County Assessor

How To Pay Property Tax Using The Alameda County E Check System Alcotube